Retirement is an essential part of life, but planning for it can be complicated. With changes in demographics, life expectancy, and economic conditions, it is more important than ever to understand the future of retirement planning and social security. This article will explore the latest trends and developments in retirement planning and social security, and how they may impact your future.

Retirement planning has become increasingly challenging due to a variety of factors. People are living longer, and the cost of living is rising. Additionally, many people are not saving enough for retirement. According to a recent survey, one in three Americans has less than $5,000 saved for retirement. With the decline of traditional pension plans and the rise of self-directed retirement accounts, such as 401(k) plans, individuals are responsible for their retirement savings and investments.

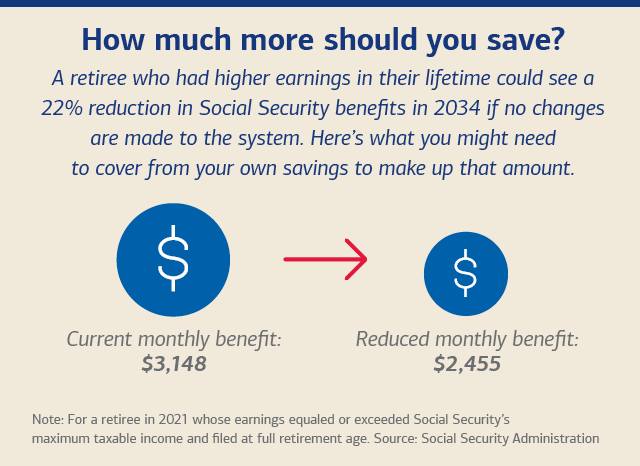

Social Security is an essential component of retirement planning for many Americans. However, it is facing financial challenges due to demographic changes, such as the aging of the population and declining birth rates. As a result, Social Security is projected to face a funding shortfall in the coming years. Additionally, changes in life expectancy and retirement age may impact how much Social Security benefits people receive.

Employer-sponsored retirement plans, such as 401(k) plans, are becoming increasingly important for retirement planning. However, many employees are not taking full advantage of these plans. According to a recent study, only 32% of workers participate in their employer’s retirement plan. Employers can play a vital role in helping their employees prepare for retirement by offering retirement planning resources and tools.

The future of retirement planning is likely to be shaped by ongoing demographic changes and economic conditions. It is essential to plan for a longer retirement period, rising healthcare costs, and potential changes to Social Security. Many financial experts recommend saving at least 10% to 15% of your income for retirement. Additionally, it is important to consider diversifying your retirement savings and investments to reduce risk and increase potential returns.

The future of retirement planning and social security is uncertain, but by understanding the challenges and opportunities, you can take steps to prepare for the future. Whether it’s saving more for retirement, taking advantage of employer-sponsored retirement plans, or diversifying your investments, there are many ways to ensure a comfortable retirement. Don’t wait to start planning for your future – the sooner you start, the better off you’ll be.

retirement planning and social security